Brief Overview of the Current Real Estate Market

Miami, a city in Florida, consists of 47 neighborhoods. According to Redfin.com, in October 2023, home prices in Miami were up 3.4 percent compared to last year.

The median price of sold homes was $558K. The real estate market in Miami is not very competitive, as the supply of homes is higher than the demand for them.

On average, homes stay on the market for 60 days compared to 61 days last year. The number of homes sold in October 2023 was 531, down from 606 in October 2022.

The Importance of Selling a House Quickly

Are you wondering, Is it the right time to sell my house fast?

The quick answer is yes. Too many uncertainties and interlocking risks in the global economy make the current period a good time to sell.

Consider the following four factors: Buyer demand is on the decline, interest rates are expected to rule high or come down only marginally in the next few months, many homes are selling below their listing price, and the possibility of a recession in the latter half of 2024 is high.

Another important factor is that most buyers feel homes are overpriced, and they are unwilling to commit at this higher price band. In this backdrop, the importance of selling a house quickly needs no emphasis.

Crucial Tips to Help You Achieve a Fast Sale

Helpful tips on the following topics are discussed in this in-depth blog post:

- Setting the right price for your home

- Selling for cash

- Targeting investors and flippers

- Creative financial strategies

- Seller financing

- Lease-to-own arrangements

- Subject-to transactions

- Wraparound mortgages

- Assumption of mortgage

- Rent-to-own options

- Hard money lenders and private financing

- Creative negotiation strategies

- Legal and regulatory considerations

- Case studies and success stories.

Set the Right Price

A. Importance of Accurate Pricing

Pricing your home correctly is a decisive factor that will determine how quickly and the best price it will sell for. Instead of pursuing a high-price gamble, it’s worthwhile to initiate the selling process at an accurate price, as it will result in a faster and more profitable sale.

An overpriced home can scare away potential buyers, as they may think that the seller is unreasonable. While you may be willing to sell your home for a lower price after negotiation, many buyers may not even consider making an offer if they feel your home is overpriced from the start.

Pricing your home right is a fine balancing act, as it will attract several qualified buyers who will look at it. There’s nothing wrong with asking as much as possible. But don’t ask so much that potential buyers are priced out and not able to buy.

At the same time, don’t cheat yourself by pricing your home lower than its true worth.

B. Conducting a Comparative Market Analysis (CMA)

A CMA will estimate the value of your home based on recently sold comparable homes (also labeled comparables or comps). Comps are similar in style, size, and location to your home.

Your first action is to research and find three to five comps within a one- or two-mile radius. To get accurate results, focus on homes sold during the past three to six months, as average prices tend to change quickly.

This analysis is easier in some neighborhoods compared to others. For instance, if your home is located in a newer development, most homes in your neighborhood may be similar to each other. But if your home is located in an older development, homes may not be similar to each other. In such cases, choose homes that are as similar to your home as you can find.

The sold price per sq. ft. is an important factor. You can get this figure by dividing the total price by the total square footage of the home.

A CMA report will typically include descriptions of your home and three to five similar homes recently sold in the area. The main considerations of your analysis will be the following elements of the homes:

- Age (year of construction)

- Condition of the building

- Square footage

- Number of bedrooms

- Number of bathrooms

- Other amenities like a swimming pool and fireplace

- Heating and cooling systems

- Yard features (such as patios or landscaping)

- Sale price

- Adjusted price per sq. ft.

C. Considering Market Trends and Conditions

When you are selling your home, don’t think like a homeowner. Think like a salesperson, instead. The prevailing market trends and conditions are decisive factors, as they impact a person’s ability to purchase your home.

Even assuming your home is in excellent shape and located in a highly desirable neighborhood, the number of homes for sale in close proximity to your neighborhood compared to the number of potential purchasers will impact your home value.

A seller’s market is one in which a lot of buyers are looking to buy the few available houses. It’s easier to sell your home in such a favorable scenario. Another advantage of a seller’s market is you can get a higher price for your home.

A buyer’s market is the opposite of a seller’s market. In a buyer’s market, the scenario is reversed, with the number of buyers being considerably lower than the number of homes for sale.

As already mentioned, the main market trends to consider are the current high mortgage rates, a looming recession in the latter half of 2024, and declining buyer demand. On the flip side, the good news is that Miami’s 25.2 weeks of supply of homes isn’t enough to keep pace with buyer demand.

The main negative is the anticipated increase in foreclosures. This is one variable that fluctuates a lot. The reason this is an important consideration is that foreclosures in Miami are expected to rise over the next few months. If this number rises to crisis levels like it did in 2008 and 2009, then the current seller’s market can quickly turn into a buyer’s market. And the problem with a buyer’s market is you will need to adjust the price of your home downward to stay competitive and attract more offers.

Sell for Cash

A. Why Sell Your Home to a Cash Buyer?

A cash buyer offers several advantages. The main one among them being while an average mortgage buyer will need a minimum of 30–45 days to close the deal, a cash buyer will take a few days to do so.

The decision of dealing with a cash buyer versus a mortgage buyer can help you when you have to deal with difficult financial circumstances. A cash buyer can be your quick answer to a simple and faster selling process.

Another advantage is you don’t need to make any changes or updates to your home. You can sell it as-is. Dealing with a cash buyer will also help you save on real estate agent commissions. A cash buyer can also help you avoid foreclosure, ensuring your credit history and financial future are secure.

B. Accept a Lower Price for an Immediate Cash Sale

It’s true that you’ll get a lower price when dealing with a cash buyer. But compared to dealing with a mortgage-backed buyer, when you accept an all-cash offer, you’ll need to communicate with fewer individuals and sign fewer papers. You’ll also have fewer costs to manage.

Unlike a sale to a mortgage-backed buyer, a cash sale will close rapidly. Your home will not sit on the market for a long time, and you’ll not need to slash its price again and again.

Selling your home can be a stressful experience. The secret to making the whole process less stressful is to deal with a cash buyer. It’s a strategic decision that can simplify the selling process for you.

Another advantage is you don’t need to rely on marketing your home. You can maximize the cash offer even without marketing. A cash offer is the best fit for you if you want to get rid of your old, unwanted home due to unforeseen personal circumstances, such as the death of a loved one, divorce, or persistent ill-health, as you can avoid the needless stress of high fees and annoying documentation.

Target Investors and Flippers

A. What Do Investors and Flippers Do, and How Do They Make Money?

The biggest difference between average homebuyers and investors (and flippers) is their primary intention of purchasing your home. An average homebuyer and their family have an emotional attachment to the home they buy and will live in it for several years. But investors and flippers have no emotional attachment to your home and look at it as simply a money-making opportunity.

Investors have cash readily available and will pay for your home in cash. They may hold your house for a short period—ranging from a few months to a few years—and sell it at a higher price. They may not spend a significant amount on the upkeep of your house.

While flippers also pay full cash upon purchase, they target distressed properties. Flippers aim to buy perfectly undervalued homes with homeowners who are highly motivated to sell fast. The home could have been struck by a natural disaster like a tornado, forest fire, or flood and be in a poor condition, with the homeowner unable to restore it to its former condition.

Or else, a rogue tenant could have trashed it, and the homeowner does not have the resources for its upkeep. Inheritance is another reason some homes are in bad shape. The present homeowner may have inherited a property that’s been badly maintained for several decades, and they live in a different state.

In essence, flippers look to buy homes that lack market demand due to their poor condition. They make some quick renovations, improve the appearance of the home, and sell it for a profit.

B. Why Should You Target Investors and Flippers?

The main advantage of working with an investor or flipper is it can result in a smoother transaction process.

While investors have extensive experience in navigating the complexities of buying and holding properties and then selling them at a higher price for profit, flippers are experts in renovating properties in poor condition. Therefore, if you are keen on a hassle-free sale, then dealing with an investor or flipper can be particularly advantageous.

Whether you deal with an investor or a flipper depends on the condition of your home. If your home is in reasonably good condition with functional accessories and amenities, you can look to deal with an investor, as you’ll get a higher price for it. Since a flipper typically buys homes in poor condition, you can consider dealing with one if your home is in poor shape and you don’t have the resources to renovate it.

Creative Financing Strategies

Introduction

For the last several months, the surging mortgage rates have pushed prospective homebuyers to the sidelines. They have been priced out due to the current high home prices and high mortgage rates.

Creative financing strategies refer to unconventional or alternative options that prospective homebuyers can utilize to acquire available houses. Generally, homebuyers opt for these methods to keep their own financial contributions to a minimum and secure better interest rates.

These strategies are viable alternatives for homebuyers who can’t make the mandatory 20 percent down payment or are ineligible for a traditional mortgage because they have a low credit score.

A. The Slowdown in Home Sales in 2023

Houses aren’t selling quickly right now (compared to 2020 and 2021) because interest rates are high compared to where they were. Existing home sales slumped to a 13-year low in October 2023. But despite the fall in sales, low inventory has resulted in home prices going up compared to this time last year.

a. The Interest Rate Scenario and the Affordability Factor

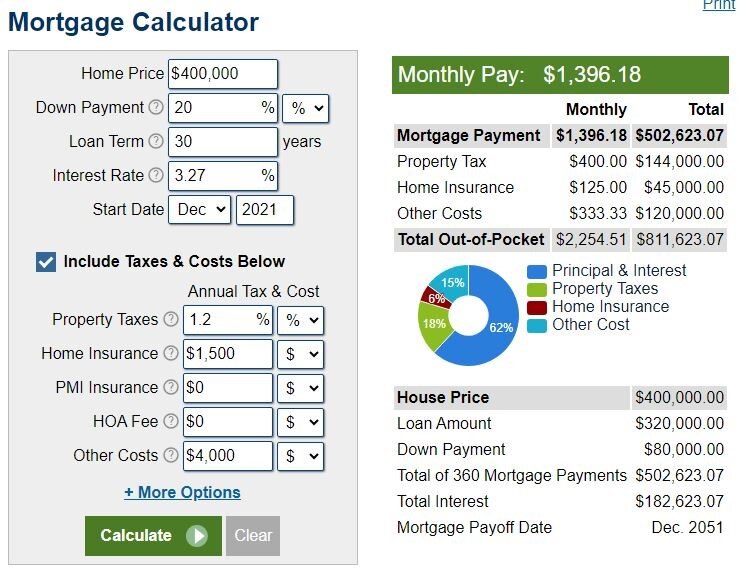

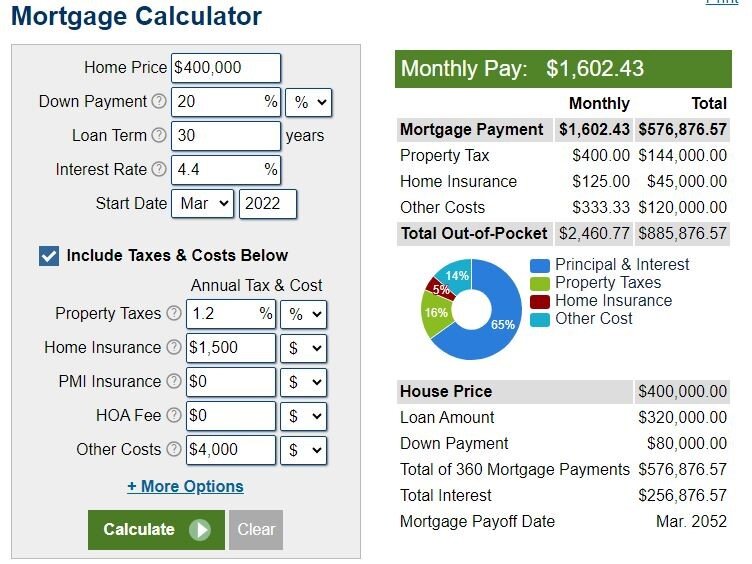

Let’s take a quick look at the interest rate scenario. The highest rate in the last 20 years that the average 30-year, fixed-rate mortgage hit was 8 percent in October 2023. This rate is currently (13th December, 2023) at 7.23 percent, up from 4.4 percent when the Fed started increasing rates in March 2022 and 3.27 percent at the end of 2021.

All this data makes one point clear: People can’t afford the monthly mortgage payments because of high interest rates.

b. Tight Inventory, Lock-in Effect, and People’s Unwillingness to Give up Their Existing Low Mortgage Rates

Let’s take an in-depth look at the data related to homeowners in the US with low mortgage rates.

A Redfin report says 91.8 percent of homeowners in the US with mortgages have locked in at an interest rate below 6 percent, 82.4 percent of homeowners with mortgages have locked in at an interest rate below 5 percent, 62 percent of homeowners with mortgages have locked in at an interest rate below 4 percent, and 23.5 percent of homeowners with mortgages have locked in at an interest rate below 3 percent.

The lock-in effect is real. Inventory has been tight for the last several months because many homeowners are not interested in parting with the lower rates they locked prior to the spike.

People don’t want to sell their houses because they already have a very good mortgage rate. They don’t want to give that up because if they move, they will need to take on a new mortgage at a much higher interest rate. Such an action wouldn’t make any financial sense. The three images below (Mortgage Calculator for Dec. 2021, Mar. 2022, and Oct. 2023) explain the reason why.

B. Introduction to the Concept of Creative Financing

In the current high mortgage rate environment, many prospective homebuyers may be interested in taking over a mortgage with a low interest rate. Taking over a mortgage is known as assuming a mortgage. In this transaction, the homebuyer will buy your home, but they will not need to apply for a whole new mortgage.

Instead, they will continue paying the mortgage from when you stop, paying the existing mortgage in accordance with the terms and interest rate already in place.

The problem is all mortgage types don’t allow loan assumptions. In some cases, mortgages can be assigned to new buyers, but in most cases, mortgages aren’t assignable.

Government-backed loans, such as United States Department of Agriculture (USDA) home loans, Federal Housing Administration (FHA) loans, and U.S. Department of Veterans Affairs (VA) loans do allow them. Traditional mortgage loans, which comprise about 65 percent of existing mortgages, don’t allow them. But this isn’t the only option. There are a host of others.

C. Other Creative Financing Options

Not everyone who wants to buy a home and can make regular monthly payments will qualify for a conventional mortgage. These borrowers can choose from a number of alternatives to conventional mortgages. Hence, borrowers with unique circumstances can opt for any one of the following creative financing options:

- Seller financing

- Lease-to-own arrangements

- Subject-to transactions

- Wraparound mortgages

- Assumption of mortgage

- Rent-to-own options

- Hard money lenders and private financing

Seller Financing: A Win-Win Solution

Seller financing is a quick way to sell your home with a broader pool of potential buyers. However, you’ll have more responsibilities, as you will need to take on the role of the bank (lender) and the mortgage payments will be made to you.

A. Why Is Seller Financing an Effective Alternative to Traditional Mortgages?

In a challenging housing market such as the current one, seller financing is the best option for many people who can’t fulfill the stringent conditions of traditional mortgages.

After the 2008 recession due to the subprime mortgage loans crisis, federal regulations (specifically the Dodd-Frank Act) have made it more challenging to get a mortgage. As a result, many Americans are being forced to pursue seller financing to buy their homes.

Traditional mortgages are somewhat one-dimensional, as people who cannot make the mandatory 20 percent down payment to purchase a home are automatically disqualified from applying for one.

On the contrary, seller financing, also labeled owner financing, is a straightforward loan contract between the seller and the buyer that circumvents this stipulation. It provides a high level of flexibility, enabling sellers and buyers to settle for mutually beneficial terms and conditions that work best for them. Seller financing gives homebuyers more control and flexibility in the home purchasing process.

B. Benefits of Seller Financing for Both the Seller and Buyer

Benefits for the Seller

- The seller is not obligated to make minor repairs or renovate the house before selling it.

- The title to the property will remain in the seller’s name until the buyer makes full payment, guaranteeing a profitable deal to the seller.

- The seller can close the deal fast, as the conventional mortgage process is completely bypassed.

- The seller will get a larger profit margin, as they are the one who will collect the down payment and interest on the loan.

- The seller is assured of a steady income stream, as the buyer will make monthly payments.

- The seller can save a lot of money on closing costs and other fees.

Benefits for the Buyer

- An accessible financing method for buyers with a poor credit rating or low income, who may not qualify for conventional mortgages.

- The buyer can get a potentially lower interest rate from the seller compared to traditional lenders.

- The buyer can get more flexible payment options and repayment terms.

- The buyer can shift to their new home faster by avoiding the conventional mortgage process.

- The buyer will incur lower closing costs, as there will be no appraisal costs and bank fees to be paid.

- Since the buyer will deal directly with the seller, they have complete control over the home purchasing process, including negotiating the final price of the home and other terms of the sale.

C. Steps Involved in Structuring a Seller Financing Agreement

A seller financing agreement between a seller and buyer should always be put on record in a written document. The document must include the specifics of the deal. While you can accomplish this in different ways, your specific needs and circumstances will determine the best option.

Explained below are the steps involved in structuring a seller financing agreement.

- Draft the seller financing documents. The most important point you must include is the total purchase price of the home, as it will help the involved parties to calculate the total loan amount.

- List the down payment that the buyer is contributing at closing. If there’s an earnest money deposit, include this amount in the agreement.

- Record the loan amount after subtracting the down payment, earnest money deposit, and other upfront payments that the buyer has made from the purchase price.

- Note the interest rate that the buyer will need to pay.

- Write down the loan term and amortization schedule. Record the loan term in terms of the number of monthly payments that the buyer will make. The amortization schedule will state the monthly payment amount.

- Set down the due dates of monthly payments and what amounts to late payment and whether there’s any grace period.

- Document the balloon payment details. While the amortization period could be 20 or 30 years, the loan term will be much shorter. At the end of the loan term, the buyer will need to make a balloon payment or lump sum payment. These stipulations may be restricted by federal law.

- Taxes and insurance payments are typically rolled into traditional mortgages. However, buyers with seller financing usually make these payments to government agencies and insurance companies directly. Regardless of how these payments are made, the seller financing agreement should record who will make these payments.

- Spell out any additional terms that are unique to your deal.

Lease-to-Own Arrangements

A. Overview of Lease-to-Own Agreements

Lease-to-own agreements, also labeled lease-option contracts, allow homebuyers to lease a property with the choice to purchase it later. The lessee (also known as renter or tenant) pays you (the lessor or homeowner) an option fee at a mutually agreed upon purchase price, permitting them absolute rights to buy your home.

A lease-option arrangement spans a fixed period (typically 3 years or less), providing the renter an opportunity to assess your home before committing to ownership. Under the agreement terms, you (the homeowner) are obligated to sell your home to the renter. Also, a portion of the monthly rent will go toward a probable down payment if the renter decides to purchase your home.

B. Advantages for Buyers with Less-Than-Perfect Credit Scores

A lease-to-own arrangement is a potential avenue for an individual with a bad credit score or limited resources at present to gradually move on to homeownership. Other advantages for a buyer include:

- Greater flexibility for the tenant, as they have the option to purchase your home but are under no obligation to do so.

- A practical try-before-you-buy option, as the renter gets to live in your home during the lease period. They have a chance to get familiar with the neighborhood, amenities, and any unforeseen concerns your home may have before committing to buy.

- The renter gets reasonable time to build equity, as a part of the monthly rent is credited toward the agreed-upon purchase price as the down payment. This can be especially advantageous for renters who don’t have enough capital to make a substantial down payment.

C. How to Structure a Lease-to-Own Deal Effectively?

The main components of a lease-to-own agreement include:

- Names of the parties involved in the sale

- The term of the agreement (e.g., 3 years)

- The final purchase price

- Non-refundable option fee to protect your (the seller’s) interests in case the buyer decides not to buy your home

- Amount to be paid as monthly rent and the due dates

- Credits from the monthly rent paid toward the purchase of your home (e.g., 25 percent of all rent payments is credited against the final purchase price)

- Who will make the property tax and insurance payments?

- Expiration date of the option to buy (e.g., 3 years from the date of signing the contract).

- Any other additional terms that are unique to your deal.

Subject-to Transactions

A. Definition and Explanation of Subject-to Transactions

A subject-to transaction is when you (the seller) sell your home with an existing mortgage to a buyer. The buyer will take over the mortgage payments without you (the seller) notifying your bank. Under the terms of this transaction, even though the buyer will take over your property, you will retain the mortgage. The buyer will make mortgage payments on your behalf, and you don’t inform the lender that you have transferred your home to the buyer. While a subject-to transaction is a risky strategy for the buyer, it’s a way for you to unload your house fast and avoid a foreclosure.

B. Benefits and Risks for Both Parties

Benefits and Risks for Buyers in Subject-to Transactions

Benefits:

- Buyers with low credit score who can’t secure traditional financing can buy a home.

- Buyers who lack the capital to make the mandatory 20 percent down payment can buy a home.

- Buyers can save a lot of money, as they will need to pay fewer associated real estate fees and costs.

- Faster transaction time, as buyers can take over the property immediately via a deed from the seller.

- Buyers can lock in a low mortgage rate in the current high mortgage rate environment.

Risks:

- The main risk is that the seller’s lender could trigger the due-on-sale clause (also known as the acceleration clause) incorporated into most traditional mortgages and notify the loan amount due for breaching this clause.

- The seller could file for bankruptcy, forcing the seller’s lender to foreclose the property. This could result in the buyer losing their investment.

- The buyer is taking a huge risk by not notifying the seller’s lender of the property transfer and simply hoping that they don’t notice.

Benefits and Risks for Sellers in Subject-to Transactions

Benefits:

- If you have fallen behind in your mortgage payments, the buyer can bail you out.

- If you believe that a foreclosure is imminent or are facing foreclosure proceedings, you can avoid the negative impact it will have on your personal credit history.

- You will have monthly on-time payments reflecting on your credit report as the buyer makes the payments on your mortgage.

Risks:

You must ensure the buyer has adequate resources to make the monthly mortgage payments, as the buyer does not need to provide any assurances to you that they will continue making the mortgage payments. In the event the buyer stops making the mortgage payments, you have little or no legal recourse against the buyer and you cannot get your home back.

C. Legal and Ethical Considerations When Using Subject-to Financing

Subject-to financing often gets a bad reputation. They are sometimes labeled illegal or unethical. While subject-to transactions can be advantageous for both buyers and sellers, the right protections need to be put in place.

The best strategic tool to mitigate the real risks associated with the due-on-sale clause (or the acceleration clause) is the land trust (also referred to as grantor trust).

In a subject-to transaction, it’s essential for both the seller and the buyer to delve deeper into the specifics, and strive to understand the potential risks and the legal implications before finalizing the deal.

Wraparound Mortgages

A. Understanding the Concept of Wraparound Mortgages

Wraparound mortgages are very similar to subject-to transactions, except that the seller’s bank knows about the sale and the subsequent transfer of the property title to the buyer.

A wraparound mortgage allows you to generate additional profit as a lender. In this contract, the buyer of your home will send their monthly payment to you. You will use part of this amount to make the mortgage payment. The remainder is your profit.

Since you can charge a higher interest rate than the one you’re paying, you’ll earn a profit in this deal. The buyer, in turn, will get financing when a cheaper option isn’t available.

The loan you provide to the buyer is the wraparound mortgage. That is, your loan to the buyer wraps around the original mortgage loan.

B. How Can Wraparound Mortgages Benefit Sellers?

A wraparound mortgage allows you to generate additional profit as a lender. In this contract, the buyer of your home will send their monthly payment to you. You will use part of this amount to make the mortgage payment. The remainder is your profit.

Since you can charge a higher interest rate than the one you’re paying, you’ll earn a profit in this deal. The buyer, in turn, will get financing when a cheaper option isn’t available.

C. Risks and Considerations for Both Parties

If the homebuyer doesn’t make monthly payments, you will have to face the foreclosure process—in case the buyer has been put on the title. If not, you will face the eviction process. Depending on your state’s regulations, this process can be expensive and time-consuming.

Similarly, if the buyer honors their end of the contract and makes monthly payments on time, but you (the seller) don’t transfer part of this amount to make monthly mortgage payments, the original lender can foreclose on your home.

Therefore, before you proceed with a wraparound mortgage, ensure you understand how this agreement works and are comfortable with the risks.

Assumption of Mortgage

A. Explanation of Mortgage Assumption

Mortgage assumptions go through times of popularity and insignificance, depending on the mortgage rates at the time. During periods of high mortgage rates, such as the current one, assuming an old mortgage with a lower interest rate could result in significant savings for the buyer.

In a mortgage assumption, the buyer will assume the existing mortgage on your home. Typically, the buyer will pay cash to you (the seller) for your equity in your home, and then take over your original mortgage. The buyer will also make the original monthly mortgage payments at the original interest rate.

B. How Can Buyers Take Over Existing Mortgages?

The buyer can assume your (the seller’s) mortgage when you sign the balance of your loan over to them, and the buyer will be responsible for the remaining mortgage payments. The mortgage contract will have the same terms that you had, including the same rate of interest and monthly payments.

To assume your mortgage, the buyer must fulfill your lender’s qualification stipulations. This process is almost identical to applying for a standard mortgage, with the lender reviewing the buyer’s debt-to-income ratio (DTI), credit history, and other financial information. Since an appraisal of your home may not be needed, the application process will move faster than normal and is less expensive in terms of fees.

C. Benefits and Potential Challenges of Assumption of Mortgage

For many homebuyers, assumption of mortgage is a profitable deal, as it can save thousands of dollars. The buyers stand to benefit a lot as they can circumvent the closing fees typically associated with a new home loan.

However, one huge challenge for the buyer is that the amount of the assumed mortgage is usually much lower than the total purchase price of your home. This will imply that the buyer will need to come up with a higher down payment to cover your equity in your home.

Another consideration is that not all mortgage types allow loan assumptions. In some cases (around one-third), mortgages can be assigned to new buyers, but in most cases (close to two-thirds), mortgages aren’t assignable.

Government-backed loans, such as United States Department of Agriculture (USDA) home loans, Federal Housing Administration (FHA) loans, and U.S. Department of Veterans Affairs (VA) loans do allow them. Traditional mortgage loans, which comprise about 65 percent of existing mortgages, don’t allow them.

Rent-to-Own Options

In a rent-to-own option, the buyer rents your home and then has the option to purchase it for a specific price set in the lease agreement. The price may be higher than what you (the seller) would have gotten if you sold the property for cash or through a traditional sales process.

A. Advantages of Rent-to-Own Arrangements for Both Parties

Advantages for Buyers:

- They can build cash reserves to make the down payment.

- They will get enough time to rebuild their creditworthiness after debt settlement or bankruptcy.

- They can lock in the price of your home, which would be especially beneficial if the home prices have steadily climbed in your neighborhood over the last few years.

Advantages for Sellers:

- They can avoid listing agent fees.

- They can expect a steady revenue.

- They can retain larger profits on the sale of their home for future home purchase or investment.

- They can market their home to a wider pool of potential buyers compared to a traditional transaction, as both hopeful renters and prepared buyers could deal with them.

B. How to Structure a Rent-to-Own Agreement?

A rent-to-own agreement is unique to each individual and the state they live in. These contracts can be complex. Hence, you must understand all the finer details. The main components of this agreement include:

- Names of the parties involved in the sale

- The term of the agreement (e.g., 1 year)

- The final purchase price

- Non-refundable option fee to protect your (the seller’s) interests in case the buyer decides not to buy your home

- Amount to be paid as monthly rent and the due dates

- Credits from the monthly rent paid toward the purchase of your home (e.g., 25 percent of all rent payments is credited against the final purchase price)

- Whether pets are allowed

- Who will make the property tax and insurance payments?

- Who is responsible for daily maintenance and homeowner association dues

- Definition of what maintenance means: simple tasks, such as mowing the lawn and raking the leaves in the back yard, or more expensive repairs, such as fixing the leaking roof.

- Expiration date of the option to buy (e.g., 1 year from the date of signing the contract).

- Any other additional terms that are unique to your deal.

C. Legal Considerations and Potential Pitfalls

Rent-to-own contracts fall under two categories: Lease-option contracts and Lease-purchase contracts.

In the former, the tenant has the option to buy your home but is not obligated to do so. The latter, which are less common, stipulate that the tenant purchase your home.

The written contract must be signed and notarized. Both you and the buyer must agree upfront on the terms of the contract, avoiding misunderstandings down the road. The terms of the agreement must include some statutorily-imposed disclosures.

The main pitfall of a rent-to-own agreement is that renters don’t end up buying the home all the time. For instance, the renter of your home may make prompt monthly rent payments and at the end of the contract term, they may even make the down payment for your home. But they might fail to get the approval for their loan to buy your home. This is a real possibility you need to carefully consider.

Hard Money Lenders and Private Financing

From a seller’s perspective, this deal is like selling for cash because the buyer (an investor) is the one getting the loan from the private lender. However, investors typically get loans from private lenders, not traditional banks.

The advantage for the seller is that these deals can typically close faster (in a few days or a week) because experienced investors have relationships with private lenders that enable them to buy properties quickly.

A. Introduction to Hard Money Lenders and Private Investors

A hard money lender is a private individual or company that provides a short-term loan secured by a property. While a fix-and-flip loan is the main product of hard money lenders, they also offer various other products that include the following:

- Rental loans for BRRRR (abbreviation for Buy, Rehab, Rent, Refinance, and Repeat)

- Bridge loans for iBuyers

- Ground-up construction loans for single-family and multi-family developers

- Debt Service Coverage Ratio (DSCR) loans for rentals

- Portfolio loans for stabilized houses targeted toward knowledgeable investors with more than 10 properties.

The main advantage of taking a loan from a hard money lender is the time factor—investors typically get loans from them in a matter of days. A hard money lender is more concerned with the asset quality and its value over the credit history of the borrower.

Private investors in real estate are individuals or companies that provide capital for an investment opportunity in exchange for ownership of a property or equity in it. The following category of investors operate in the real estate sector:

- High-net-worth individuals (HNWIs)

- Private accredited investors

- Institutional investors (non-profit funds and pension funds) and third parties like an asset manager who invests on behalf of institutions.

B. How to Find Reputable Hard Money Lenders?

The easiest way to find reputable hard money lenders is to check out the recommendations on authority websites, such as Forbes.com, theclose.com, business.org, biggerpockets.com, and fitsmallbusiness.com.

The next step is to check out the Trustpilot Reviews of all the hard money lenders you have shortlisted. While different hard money lenders excel in different areas, the common factor is the higher interest rate they charge, which is typically 3 to 5 percent higher than a traditional mortgage loan.

Pros and Cons of Using Hard Money or Private Financing

Before looking at the pros and cons of using hard money or private financing, it’s important to understand that a hard money loan is not cash. However, this loan is often considered a cash equivalent because it differs from a traditional loan.

While a bank provides a buyer with a mortgage loan based on the market value of the acquired house, a hard money lender will provide an investor with a loan based on the expected future value of a house after renovation—not the current market value.

Hard Money Loan Pros

- Fast turnaround, as the lender is more concerned about the posted collateral. The financial position of the investor is a secondary consideration.

- Flexible terms, as the lender does not follow a traditional underwriting process. The loan’s duration and repayment schedule can be negotiated.

- Approval amount is not based on pre-qualification like in a traditional mortgage. The lender will approve an amount that the property is worth.

Hard Money Loan Cons

- The term of the loan is short. Since the lender takes on higher risk, they don’t provide long-term loans.

- The loan requires a larger down payment. Since a hard money loan entails higher origination fees and closing costs, the down payment ranges from 25 to 30 percent of the property value.

- High interest rate. Since a hard money lender assumes increased risk, the interest rate is 3 to 5 percent higher than that of a traditional mortgage loan.

Creative Negotiation Strategies

A. Importance of Open Communication and Negotiation

The key to successful negotiation in a real estate deal is effective communication. Open communication and negotiation will help you understand the buyer’s perspective better.

Since negotiations are a two-way street, you must be open to compromises. It’s unlikely that the buyer will accept your original listing price. Even in a competitive market, a buyer will typically quote 5 to 10 percent below your listing price.

In such a scenario, you could sweeten the deal by including specific contingencies that benefit the buyer, offering a fast closing process, or absorbing some of the closing costs. When you show flexibility, the chances of arriving at a mutually agreeable price are higher.

B. Tailoring Financing Solutions to Meet the Needs of Both Parties

If the buyer cannot get a traditional mortgage loan to buy your home, discuss with them and determine their specific financing needs, such as the amount they require, the interest rate, and the repayment terms. Consider your financial needs, as well.

The negotiation process must help both of you to come to an agreement that fulfills the financial expectations of both of you. Only then will it be possible to narrow down the options and find the right lender. Ensure the buyer understands the additional fees the lender will charge, such as origination fee, commitment fee, etc. As far as possible, get a detailed explanation of the lender’s fees and charges in advance.

C. An Example of Successful Creative Financing Negotiation

John, a veteran property flipper, specializes in using Other People’s Money (OPM) to clinch mutually beneficial deals. He targets properties that are in poor condition and languishing on the market for several months. Last year, he negotiated a lower price with the owner of a distressed property.

The owner had inherited this property from his mother years ago. Since he worked in a different state, he had let it out to a tenant. Although the tenant had paid the rent regularly, they had trashed the house.

As soon as the tenant vacated the house, the owner decided to sell it. The initial listing price was $300,000. Due to its state of disrepair, the property languished on the market for several months. The owner received a few offers, but the highest was only for $200,000.

John approached the property owner directly and negotiated its price down to $225,000. He agreed to fully repay the purchase price within six months without any interest, effectively bypassing the normal down payment and mortgage loan interest associated with traditional loans. This is the first step in successful creative financing negotiation. The owner agreed because he had not received a single offer during the past three months.

Within the next three months, John spent $75,000 on renovating the house. Soon after the renovation, he managed to sell the house for $400,000.

John pocketed $100,000 after paying the original property owner the amount he had agreed to pay. In the end, he was able to generate great returns by tying up minimal capital.

Legal and Regulatory Considerations

A. Seek Legal Advice Before Engaging in Creative Financing

Legal matters in real estate are not do-it-yourself friendly. Therefore, before you engage in creative financing for real estate transactions, you must grasp the legal aspects involved. The only way to prevent or, at least, be prepared for unforeseen complications is to have a thorough understanding of the legal implications of these financing strategies.

When you engage in real estate transactions, it pays to be doubly cautious. Conduct a meticulous due diligence check before you enter into any agreement to minimize legal risks.

B. The Need for Understanding Local Regulations and Laws

Every state has unique real estate laws. These regulations also extend to creative financing methods. When you engage in a real estate transaction, you must ensure that you fully understand and abide by the real estate regulations and laws in your state.

From environmental regulations to local zoning laws, title searches, honest disclosures, property inspections, and understanding and abiding by these legal aspects will safeguard you and ensure a trouble-free real estate experience.

C. Potential Implications of Creative Financing on the Closing Process

Most of the creative financing strategies discussed in this in-depth blog post can simplify approvals and speed up the closing process. The main advantage of creative financing is that anyone interested in buying or selling real estate can explore the available financing options. They can evaluate their specific needs and pick the option that fulfills their needs the best.

The most effective way to utilize these creative financing strategies is to think outside the box. These strategies provide wealth-building opportunities for people at every level.

Conclusion

A. Recap of Creative Financing Options Discussed

Creative financing is an all-inclusive term. In this detailed blog post, we have discussed the salient features of different creative financing options, such as Seller financing, Lease-to-own arrangements, Subject-to transactions, Wraparound mortgages, Assumption of mortgage, Rent-to-own options, and Hard money lenders and private financing.

If you are still wondering, Can I sell my house fast? you need not worry. These strategies are especially useful to owners of distressed properties who are having difficulty in selling their homes. With these options, they can attract a bigger pool of prospective homebuyers and renters.

B. Why Is It So Important for Sellers to Explore Alternative Financing Methods?

Seller financing has become popular due to the current high mortgage rates. The major advantages of this financing strategy are you have a chance to get a fair price for your home and you can make money on interest, as well.

The tax and revenue benefits of seller financing are huge. The sale of your home involving a lump sum payment on the closing date can mean a huge tax outgo. But if you structure it as an installment sale and collect regular payments over an extended term, you can realize the gains over many years. Thus, you can defer tax payments on the sale of your home.

C. Reminder to Seek Professional Advice and Guidance When Implementing Creative Financing Strategies

The need to seek professional advice and guidance in a real estate transaction needs no emphasis.

Seek expert legal advice and ensure that any contracts you enter into offer you maximum protection and safeguard your financial interests. When you sign property-related documents, you must read the fine print and understand the long-term implications.